1) Why does this play an important role in the data request management?

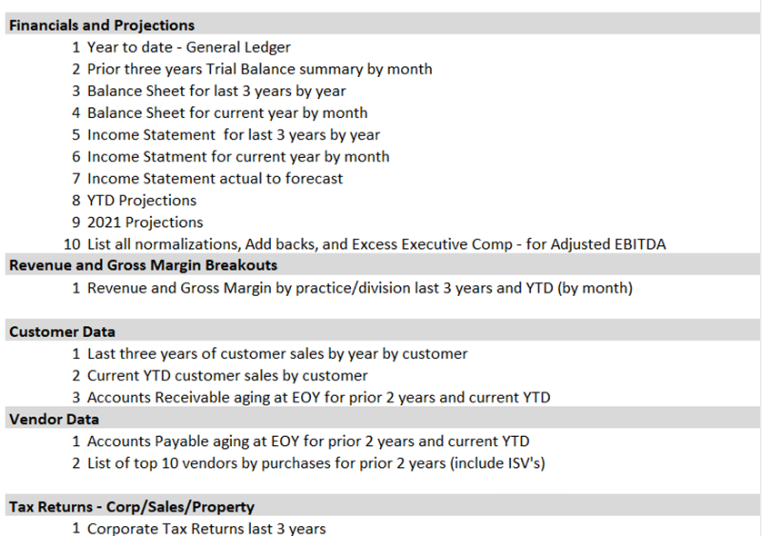

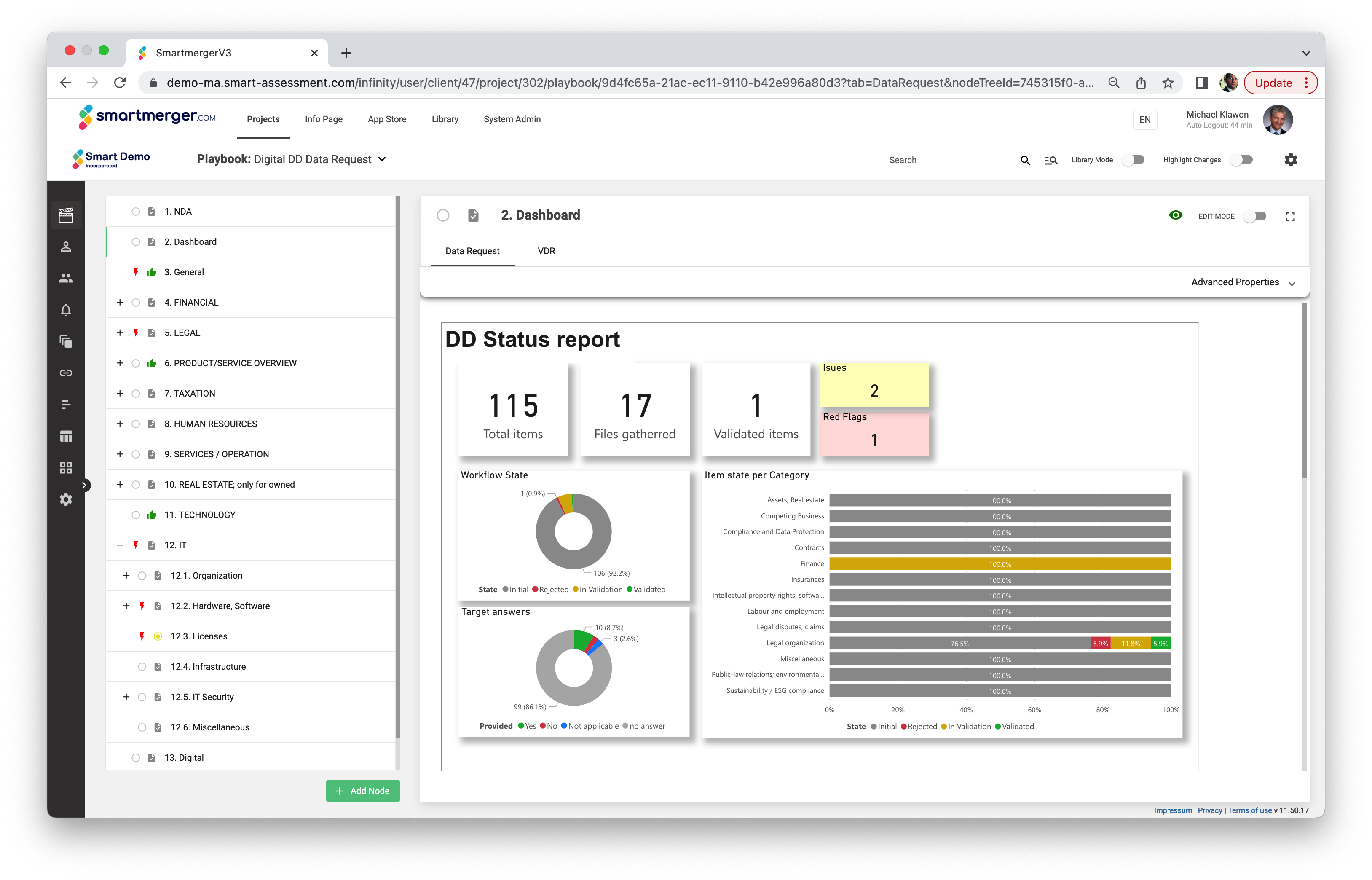

Let's start with the concept of data request management. It is a common practice in any buying process to conduct an "evaluation" of the object to be purchased. The purpose of this evaluation of factors that determine its value, as well as the risks and limitations associated with it. For a comprehensive evaluation, a prepared due diligence checklist that includes all the questions the buyer wants to ask the seller is essential. Ideally, the seller will have anticipated these questions and will have the answers ready. However, these checklists can become comprehensive when acquiring an entire company. In a buy-side transaction where the buyer leads the process, the seller receives a "data request list" listing all information to be provided. The buyer, in order to verify that all the necessary information has been provided and validated, will also maintain his enhanced version of this request list, known as a due diligence (DD) checklist.

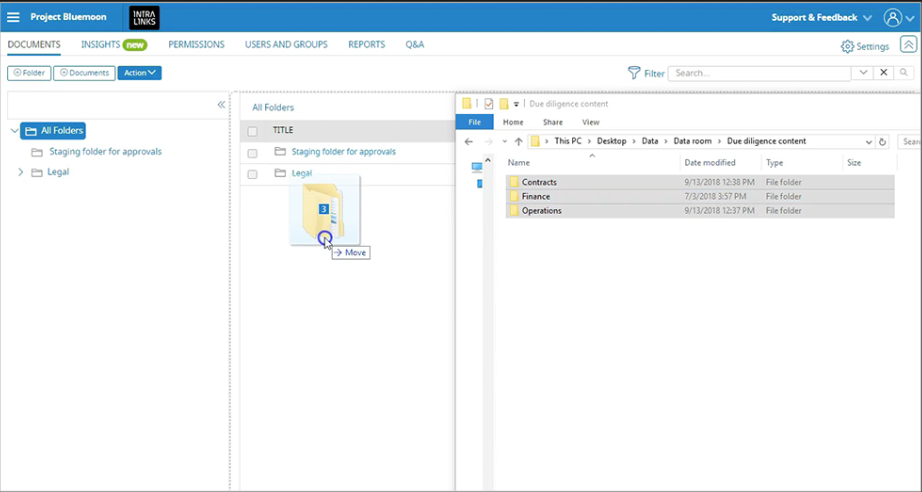

Once the information to be exchanged has been identified, the next consideration is the appropriate location for the storage and sharing of sensitive and confidential data. In a traditional M&A transaction, the buyer typically sets up a virtual data room (VDR) that serves as a secure online document repository. The VDR is organized into folders and subfolders that mirror the data request list structure. The set-up implies that the buyer expects to receive documents from the seller. The seller then gathers the requested information, prepares the necessary documents, and uploads them to the VDR. The buyer and his team reviews and validates the documents and will request updates or remind to provide missing information. We intentionally do not cover the remaining steps to complete the purchase process, such as valuation, preparation of the due diligence report, negotiation and signing of the sale and purchase agreement (SPA), because the focus of this article is on data request management.