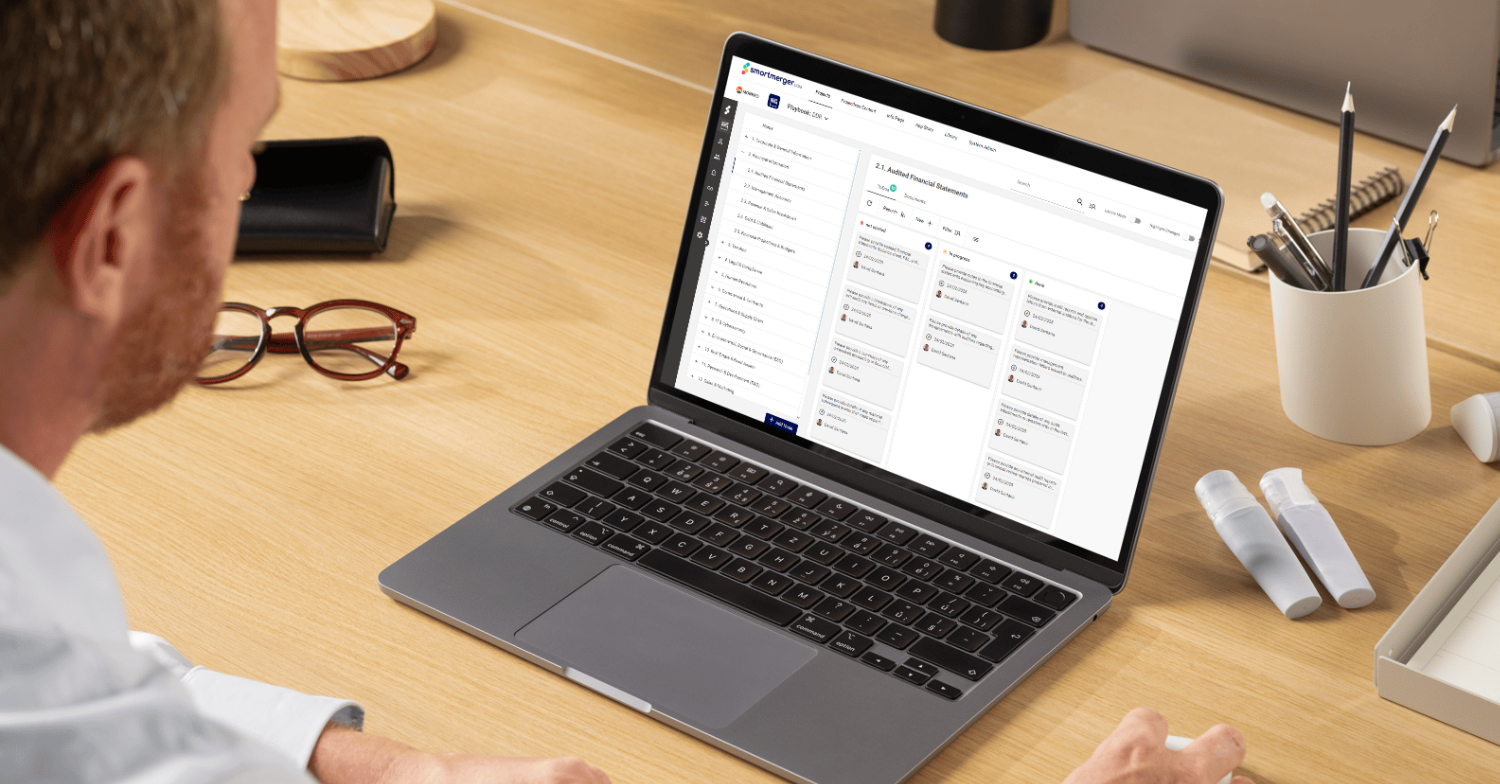

1. What does smartmerger.com® do?

We provide a full online application suite to make your M&A more efficient. Our applications can be used as standalone apps for a specific purpose or a single project phase, or combined as a suite supporting end-to-end data management throughout the entire M&A cycle. Our unique ability to manage structured data allows you to capture, process and manage all M&A data on a single platform. Through our open API, we can even integrate with third-party applications and data sources, giving you a real single source of truth.

The smartmerger.com® platform is natively designed and built for M&A only. We are not a standard platform with some M&A features, and we are way more than a VDR or playbook. We provide a comprehensive platform, a centralized workplace for all your people and data. We deliver highly secure collaboration functionality that lets people work together in real-time. This includes process and project management, data and document management, reporting and dashboarding.